Descargar Dossier completo en pdf

Download complete Report in pdf

The fall of the Cuban peso (CUP) against the dollar experienced in recent weeks denotes the government’s inability to reverse this situation that has already gotten out of control. The big culprits of inflation are GAESA -linked to the Castro clan and their cronies- and Miguel Díaz Canel, the president imposed by Raúl Castro.

The root causes of this unstoppable inflation are the corrupt control that GAESA -a corporation above all audits- has had over the country’s finances for the last 8 years through the International Financial Bank (IFB), the government’s subservience to GAESA and the lack of intention for a restructuring of the economic model that has more than demonstrated its inefficiency. In the absence of a real plan, the government has become bogged down in improvisation, mediocrity, and ideological entrenchment, which far from bringing positive solutions for the economy, has resulted in the breakdown of the financial system and its consequent domino effect in the brutal increase in the prices of products and services that are vital for the population.

The implementation of disruptive measures has collapsed the economy affecting most of its major industries and economic sectors, including the financial sector.

Measures such as the creation of the so-called MLC stores[i] , the implementation of the Monetary Ordering Task[ii] , the prohibition of physically depositing dollars in bank accounts[iii] and the implementation of the new exchange market[iv] unleashed an inflationary spiral that today has proven to be unstoppable.

The latest disruptive measure that has accelerated and further escalated the inflationary crisis was the increase in fuel prices by 500% and electricity rates by 25%. This has driven up the price of commodities and transportation. In practice, this measure has accelerated the inflationary process by reducing the real value of salaries, which are insufficient to cover the high cost of living. Today hundreds of thousands of Cubans eat only once a day.

On the other hand, GAESA’s control over finances and the economy prevents the implementation of a coherent program that would truly transform the economic model and pull the country out of the multi-systemic crisis in which it is mired.

In this sense, it is worth mentioning the terrible management of investments, which have been executed at the convenience of the lucrative interests of the oligarchs that control GAESA. This has left the state itself without resources, which has passively seen how its most emblematic industries and sectors have collapsed (food industry, energy, transportation, health services, sugar industry, education), due to the lack of financial resources and the absence of an investment policy consistent with the true needs and strategic priorities of the country and not of that corporation. These are irrefutable facts that show the real subordination of the Cuban government to GAESA and the absence of institutional mechanisms to control and supervise the non-transparent operations of that corporation.

Díaz Canel’s “continuity model” has caused the Cuban financial system to collapse.

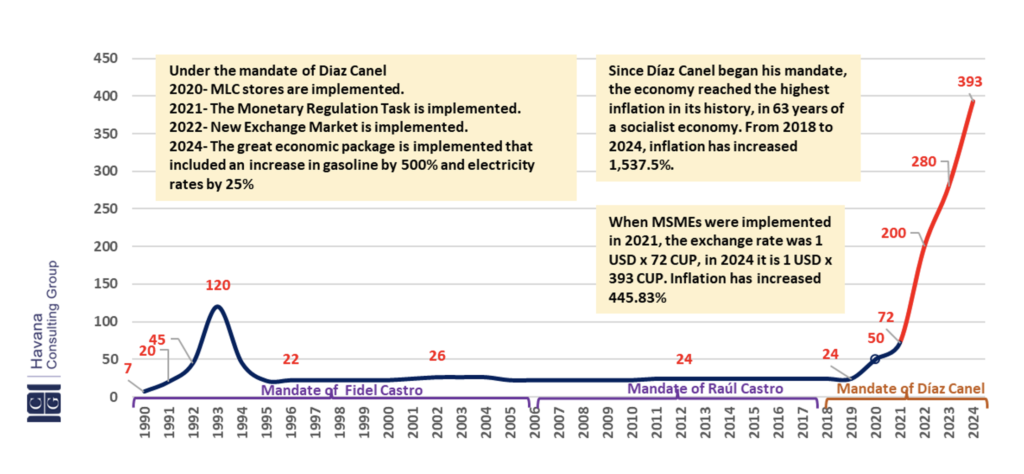

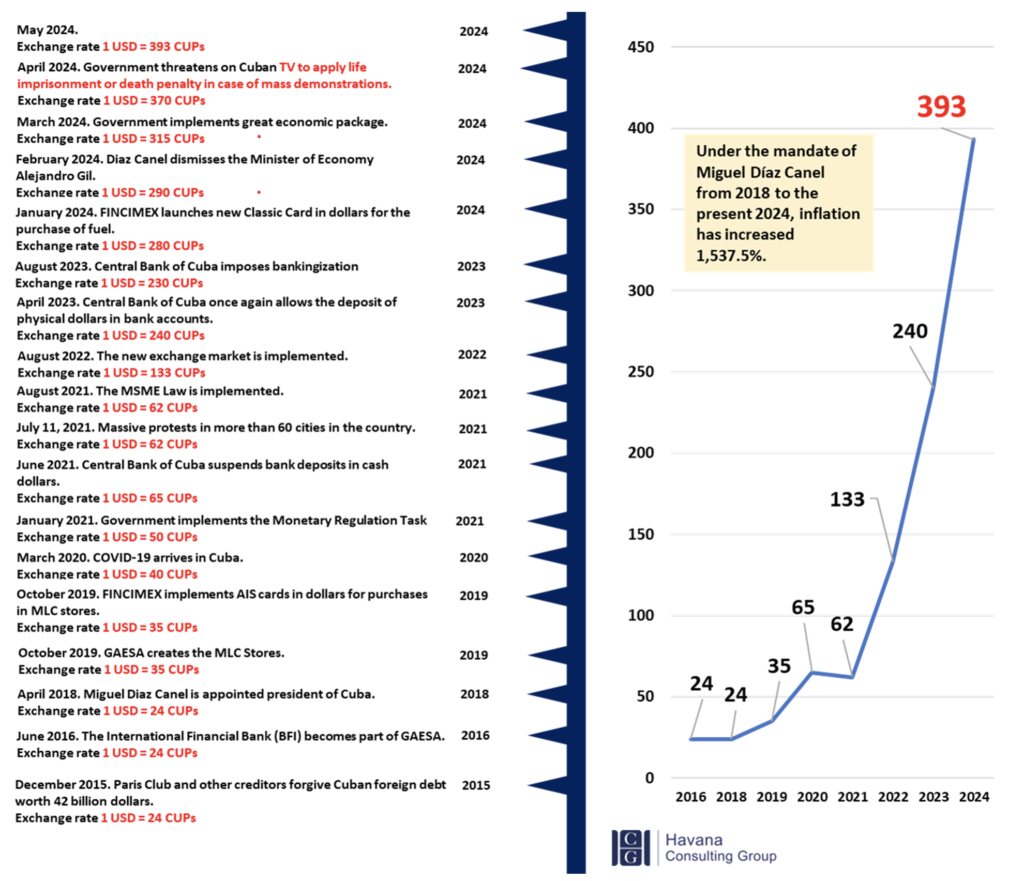

When Miguel Díaz Canel was appointed president of the country (October 10, 2019), the dollar was trading at 1 x 24 CUPs. Today (May 9, 2024) the dollar is trading at 1 x 395 CUPs. This means an increase of 1,537.5%. It is obvious that the management of the government team led by Díaz Canel has been a great failure. See Figure 1.

Figure 1. Evolution of the exchange rate of the dollar vs. the Cuban peso. Period 1990-2024.

To begin to describe the disastrous management of Díaz Canel and his team, we must remember the disaster caused by the Monetary Ordering Task, which was implemented to eliminate the dual currency and turned out to be a multiplying measure in the number of currencies controlling the country’s economy: the dollar, the euro, the MLC, and the Cuban peso CUP.

Cuba’s disastrous financial system

If we make a structural analysis of the Cuban financial system, it is very easy to see that it reflects real chaos. Currently, there are three exchange rates for the Cuban peso: an informal variable rate (currently 395 CUP for one USD) and two official constant rates (one of 24 CUP for 1 USD and another of 120 CUP for 1 USD). Such diversity in the exchange rate distorts the functioning of the market, hinders the business activity of state and non-state enterprises, hinders productive processes, affects the prices of products, and reduces the purchasing power of workers’ salaries and retirees’ pensions. This results in the bankruptcy of companies, shortages of products, higher cost of living for the population, a drop in production and exports, and increased dependence on imports of products from abroad.

To this disaster must be added Cuba’s wealthy foreign debt, which is suffocating the country’s economy. Cuba has defaulted on its payment commitments to debtors who forgave and/or restructured payments on a debt of $42 billion in 2015[v]. Today the country owes around 46,000 million dollars of which they only recognize around 20,000 million[vi] and has no credit lines for being a bad payer. Not even its political allies such as China and Russia grant important credit lines, as they do not consider Cuba a reliable economic partner.

To make matters worse, the Cuban financial system has practically run out of cash. Neither workers nor retirees can even collect their salaries at banks and ATMs[vii]. This situation has become generalized throughout the country. The money has gone to the informal market, it does not return to the financial circuits of the Cuban state. The state has also run out of capital to print money.

Chronology of inflationary escalation

In order to understand the situation in which the country finds itself today from the financial point of view and to understand how this inflationary crisis has come about, it is necessary to reconstruct the factors and facts that have been concatenated over the last eight years and that have resulted in this inflationary crisis that is shaking the country today and has plunged more than 80% of the Cuban population into poverty.

The beginning: control of the International Finance Bank

It all started when GAESA took control of the country’s finances for its own convenience. To this end, in June 2016 in an obscure and non-transparent operation the Central Bank of Cuba (BCC) ceded the International Financial Bank (BFI)[viii] to GAESA’s business structure.

Missed opportunities and a chain of mistakes

It is important to note that, previously, in 2015 the Cuban regime because of the global influence of the thaw with United States managed to clean up the foreign debt when several creditors including the Paris Club wrote off $42 billion and restructured the payments of about $9.466 billion that remained to be paid.

In April 2018 Díaz Canel was appointed president of the country. However, in his speech as president, he expressed that Raúl Castro would make the most important decisions. In this way, a red line was marked on what Díaz Canel could and could not do even as president of the nation[ix] . By that time, 2018, the exchange rate in the informal market was 1 USD for 24 CUP.

Figure 4. Chronology of events that have unleashed the Cuban inflationary crisis, 2016-2024

How to eliminate financial chaos?

To eliminate all this financial chaos, it is imperative to put order in the government itself. First, the Central Bank of Cuba (BCC) should take back the role it’s supposed to play that it conceded to GAESA BNC should take advice and follow international standards on how it should handle the financial industry and the economy to address the issue of inflation. To do so, it should take the step of recognizing the exchange rate in the informal market and adjust an exchange unification plan. On the other hand, it must curb the uncontrolled issuance of cash without productive backing and make a drastic reduction in public spending, in order to reduce the fiscal deficit. Along with this, it must carry out a profound financial reform that will allow it to regain control of the country’s finances. For this, it is essential that the BCC take control of the BFI and supervise the financial and banking activity of GAESA.

Likewise, the government must implement a transformation of the economic model that contemplates a true opening towards a market economy with the unconditional liberation of the productive forces. It must urgently reorient the investment priorities in the country and put the resources in the strategic sectors that the economy needs and guarantee that they are supervised and controlled by the government agencies created for this purpose and not allow a group of oligarchs to dispose of the country’s finances at their own free will and convenience.

It must take serious steps to allow investment by Cuban exiles without limiting conditions, create a legal framework that supports and stimulates the development of a free market economy, where, among other things, private banking is also allowed. In addition, it must begin to pay the debt to its creditors, renegotiate outstanding debts, resolve pending lawsuits in court and try to regain the confidence of creditors to regain access to credit lines. If anyone thinks that the author’s recommendations are too many, it is the fault of those who allowed the problems to accumulate.

Conclusions

The Cuban economy is mired in an inflationary crisis that the government has not been able to stop. The main culprits of this situation are not the embargo, nor the U.S. sanctions, but an internal problem: an obsolete and collapsed system together with the bad management of those who run it.

As has been documented, those supremely responsible for this inflationary crisis are GAESA and President Miguel Díaz Canel. The war against the Cuban economy exists, but it is not directed from a CIA department, but from the offices of the directors of GAESA and its presidential wimp, Díaz Canel, in the Council of State. They are the ones who have destroyed it.

The unstoppable inflationary crisis is the result of a deliberate and corrupt policy with serious impacts on the welfare of the population. Its true authors unleashed it by bypassing all the powers of the state institutions in charge of controlling the nation’s finances to embezzle the country’s financial resources.

They have plunged millions of Cubans into poverty. Hundreds of thousands can only eat once a day. They have deprived the population of the right to satisfy basic needs such as transportation, water, electricity, food, and medicine. To deprive citizens, because of deliberate policies, of essential services that degrade their existence and block basic freedoms that allow them to create wealth and hope that things can change is tantamount to a genocidal act of a failed state. This unnecessary humanitarian crisis has generated in recent years, only to the U.S., an exodus of 723,146 Cubans fleeing hunger, misery, and lack of opportunities. Today’s Cuba has no future projection. The Cuban oligarchs have forbidden dreams.

But the most repugnant thing is that the totalitarian mafia state that has generated this crisis situation with its blockade of basic freedoms and corrupt administrative management now threatens on television with life imprisonment and the death penalty any citizen who decides to claim his rights through demonstrations -civic and peaceful- such as those that took place on July 11, 2021 and March 17, 2024.

To get out of this crisis, the only possible solution is a change of the current system that puts an end to the power of GAESA and the hegemony exercised by the Communist Party of Cuba (PCC) over society and its institutions. To begin this path, it is essential to implement the five basic political, civil, economic, and social liberties that the population is starting to demand.

References

[i] Central Bank of Cuba. “Cuban Government Reports New Measures for Merchandise Sales in MLC.” July 2020. https://www.bc.gob.cu/noticia/gobierno-cubano-informa-nuevas-medidas-para-las-ventas-de-mercancias en-mlc/783.

[ii] MINREX. “Inicia el 1ro de enero ordenamiento monetario y cambiario en Cuba”. December 2020. https://cubaminrex.cu/es/node/3910

[iii] Granma. “Cuba temporarily suspends acceptance of U.S. dollar cash bank deposits.” Junio 2021. https://www.granma.cu/pensar-en-qr/2021-06-10/en-vivo-informan-temas-de-interes-especial-para-nuestro-pueblo-10-06-2021-19-06-45

[iv] Granma. “Cuba initiates the purchase of foreign currency by the State with new exchange rate”. August 2022. https://www.granma.cu/cuba/2022-08-03/informan-sobre-la-implementacion-del-mercado-cambiario-en-cuba

[v] Adams, David. “CUBA 2016: The Havana Consulting Prognosis.” THCG BUSINESS REPORT FEBRUARY 2016 No.1. The Havana Consulting Group and TECH.

[vi] HCG Business Intelligence Unit. “Regime’s finances sink as foreign debt suffocates it.” THCG Business Report, October 2023 Nº5, THCG & TECH.

[vii] DDC. “‘Literally empty’, Havana’s banks have no cash”. Junio 2023. https://diariodecuba.com/economia/1687905645_48140.html

Cruz, Rafaela. “Cuba, without money or to print money”. DDC. Mayo 2024. https://diariodecuba.com/economia/1685017056_47392.html

[viii] CUBANET. “GAESA absorbs International Financial Bank.” June 2016. https://www.cubanet.org/destacados/gaesa-absorbe-el-banco-financiero-internacional/

[ix] INFOBAE. “Miguel Díaz-Canel was appointed Cuba’s new president, but said that “Raúl Castro will make the decisions of greater transcendence””. April 2018. https://www.infobae.com/america/america-latina/2018/04/19/miguel-diaz-canel-fue-elegido-nuevo-presidente-de-cuba-en-lugar-de-raul-castro/